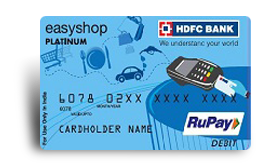

Ok so, since you are reading this article, you might have made up your mind to get Debit Card. Now if you are having HDFC bank account and want to have one of this card or you want to leave away those master or visa card and have doubt as how to get one, then read below to get Rupay Debit Card.

How to Get HDFC Rupay Debit Card

There is two option, either you already have a HDFC Bank account and want this card or you want to open a hdfc bank account and opt for rupay debit card. Both way you can get Rupay debit card. Let's discuss one by one.

Also, now a days if you have HDFC Netbanking ID password, then there are lot of feature which you can do it direct from your home without visiting the branch ever.

Case 1: If you already have HDFC Account

- Visit your home branch and get a form from them. Or you can download that form from this link.

- In the form you have to fill all the necessary details about yourself and the account.

- Go and submit the form at the bank. Make sure that the mailing address you have entered is correct as you will get Rupay card at your home.

- You can use both Master/Visa Card and Rupay card for the same account.

- You will receive your card after certain days, as mentioned by the bank.

- After receiving the card, you have to swipe it at the ATM before using it for other payments like online shopping etc. This is mandatory as per the RBI guidelines. After doing that, you can use it anywhere.

Case 2: If you don’t have an HDFC bank account

- Visit your nearest HDFC bank branch and ask for the form for what type of accout you want to open like savings, NRI etc. Carry all the necessary documents needed for the account opening like id proof, resident proof, photos, pan card etc.

- Fill the form and enter your details properly. After that apply for this card as mentioned in the form.

- Handover the form to bank officials.

- They will open your account in one day and you will receive your Rupay card at home, in the prescribed time interval.

- Here is the link to download the form for opening a new account.

A nominal fees of Rs 150 needs to pay by the user to take advantage of this card, every year. In case you are exchanging the damaged card with the new one then you have to pay nothing. But in case you card is lost, then charges for getting a new one is Rs 200. If you are planning for slip retrieval request then you have to pay Rs 100 for it.

Note: The amount given above might change time to time, please confirm it with bank before applying for their services.